Blog

All Blogs

By Mara Chaben

•

February 27, 2025

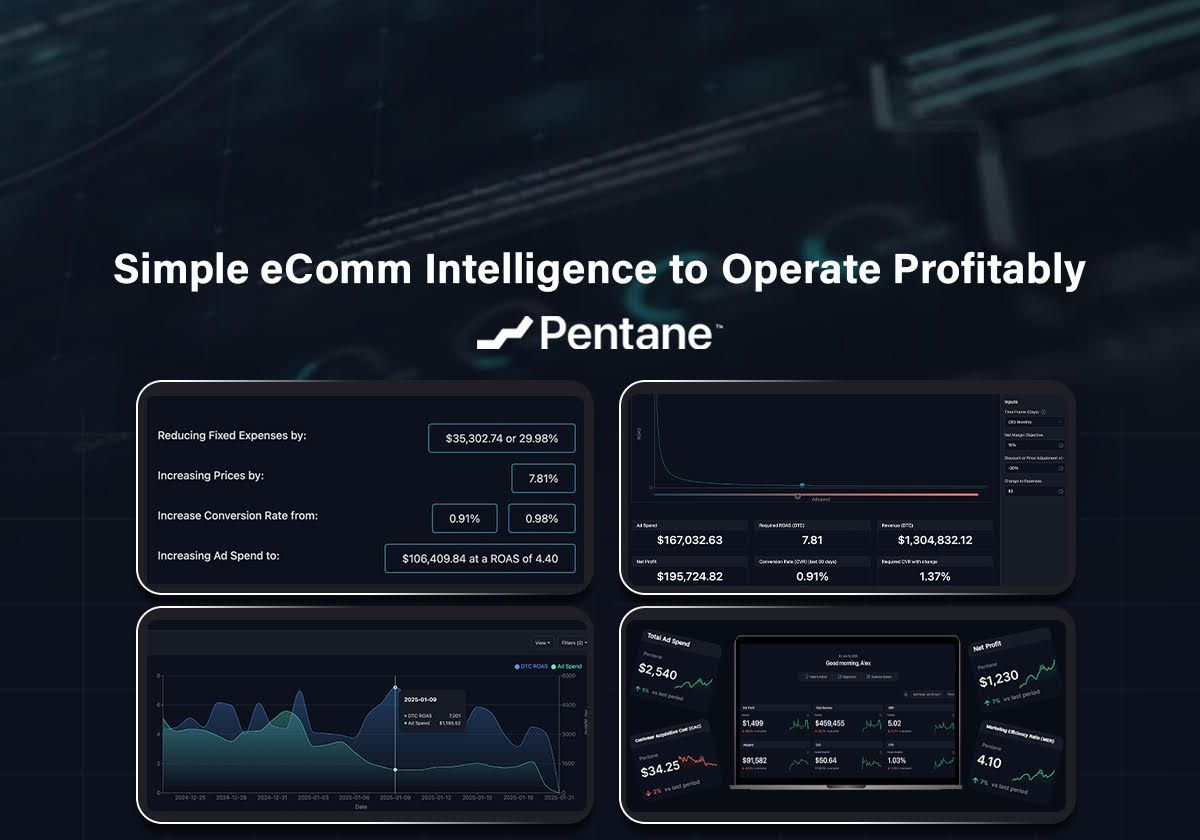

At Hawke Ventures, we focus on investing in early-stage companies building the future of Commerce Tech, MarTech, and AdTech. One of our latest investments is Pentane, and we’re excited to support the team on their journey. Ecommerce brands often struggle to navigate the intersection of finance and marketing, where decisions about profitability and growth meet. Pentane addresses this pain point by providing a platform that integrates financial and advertising data, helping brands make informed, data-driven decisions that were previously complex and difficult to answer. The platform integrates data from Shopify, Amazon, Google Ads, QuickBooks, Meta, and other key systems to provide math-driven answers such as: What do we need to spend on ads to be profitable? Is our new advertising strategy working? How does ROAS need to perform? What if we run a sale or discount? Add or remove expenses? And much more… The purpose of Pentane is to create real-time clarity around how efficiency (or lack thereof) is driving profits or losses for a brand, then show you exactly what to change to fix the problem. GP at Hawke Ventures, Erik Huberman, says, “We frequently see companies getting great returns on their ad spend but choose to cut back to save money because they don’t understand how the ad spend impacts the company.” Pentane helps business owners visualize how changes to ad budgets affect revenue and contribution margin. This information can help brands make faster and more effective marketing decisions - it’s also helpful for our paid media team at Hawke Media. Most e-commerce brands aren’t spending enough, and they are leaving net income dollars on the table because of it. Pentane clearly defines what they should or shouldn’t be spending to create the outcome they want. Pentane’s founder, Adam Callinan, has a proven track record as an entrepreneur with two successful exits. He previously bootstrapped BottleKeeper, an e-commerce company that reached tens of millions in sales with just four employees before being acquired by Wind Point Partners in 2021. His deep understanding of e-commerce metrics and pain points is helping the team drive Pentane’s product development and scale. The market for e-commerce profitability tools is massive, with an estimated total addressable market of $55 billion in the SMB e-commerce segment alone. When considering the broader SMB market, encompassing various industries and sectors beyond just e-commerce, the total TAM is estimated to be $312B. We’re excited about Adam’s vision for Pentane to replace outdated tools like QuickBooks with a modern, dynamic solution built for today’s e-commerce brands.

By Mara Chaben

•

May 17, 2023

People who are referred to a product by a friend are 4 times as likely to buy a product, with word of mouth influencing a 54% increase in marketing efficiency. Not to mention, the average American citizen mentions brands over 60 times weekly, with 90% of these name drops happening online. Yet, existing referral and word of mouth programs are difficult to use, tend to have low utilization rates (due to poor usability and outdated commerce experiences), and struggle to capture the voice of the customer. In addition, most influencer campaigns drive shoppers to a homepage or PDP that cuts the influencer out of the shopping experience. That’s why we’re excited about leading Superfiliate’s Seed round alongside Vanterra Capital, R-Squared Ventures, and Sandbox Studios Ventures. Superfiliate’s mission is to transform word of mouth marketing for ecommerce brands, creating a worthwhile experience for customers and creators to share with their friends and followers. The product generates ROI driven personalized storefronts for customers and creators, creating a referral experience that is actually worth sharing. Their programs and landing pages convert much higher than typical referral and affiliate programs. For example, florence by Mills auto generated 2000+ personalized storefronts for their customers using Superfiliate while experiencing a 25% increase in conversion driving a 16x ROI. “It drastically improves marketing efficiency and reduces [cost-per-actions] which are critical metrics for brands these days,” Superfiliate CEO Andy Cloyd tells Axios . CEO Andy Cloyd and CPO Anders Bill have the right DNA to win this category. Andy and Anders have taken their time in building a solid foundation for Superfiilate, and are now poised to scale across the ecomm ecosystem. The 2023 Commerce Report penned by the team at Shopify Plus relays, “Experience-driven, customer-centered loyalty programs aren’t yet the norm, but they’re likely to be within a few years. Almost 72% of the global brands surveyed by loyalty tech provider Antavo are already planning to revamp their existing programs.” At the very core of its expansive platform, Superfiliate is the catalyst for amplifying customer engagement. In this economic climate, brands need to find a way to expand their 5% highly engaged, super loyal fans to 10 - 12% or more. Superfiliate is that solution by making “the fan club” a better experience. - Hawke Ventures is an early-stage venture fund that invests $50k-$2M in commerce enablement, MarTech and AdTech. Between Hawke Media's client base (400+ monthly brands), growth marketing expertise (200+ employees), and Hawke Venture’s track record in early stage investing, the firm has a strategic ability to attract and develop world class entrepreneurs in commerce enablement and marketing technology.

By Mara Chaben

•

February 14, 2023

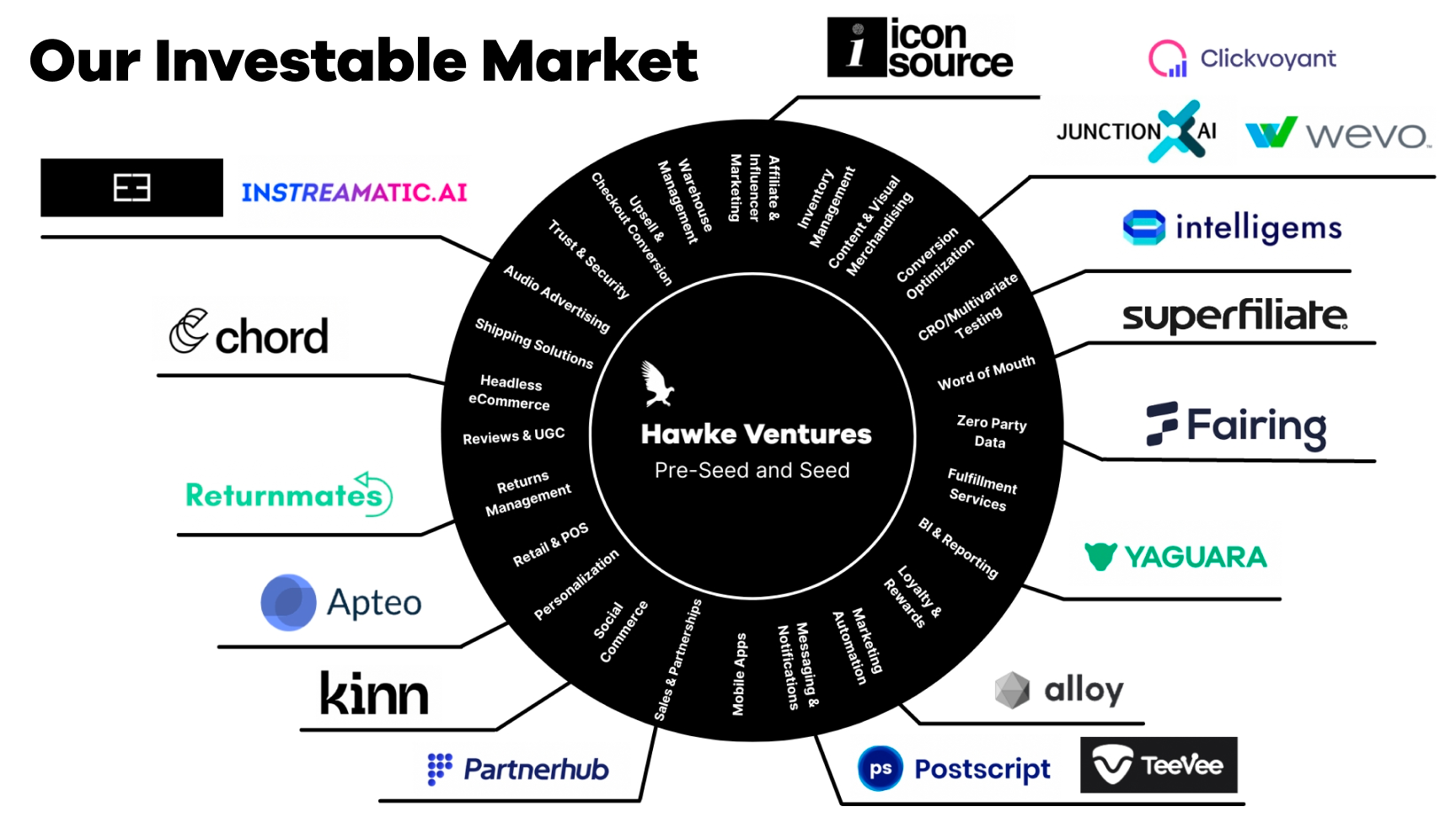

Over the past year, the rollercoaster of public markets, venture, and our macro economy continues to awaken our senses every single day. We know that tough times create the “nice to haves” and “must haves” in the market. We know that the “nice to have” softwares and tools are getting nixed, and the “must to haves” - things that generate sales - are getting adopted. The next 18+ months will be the golden era of what we do - invest in tech that produces sales. The Hawke Media engine continues to produce an amazing alpha for Hawke Ventures that makes us excited to build an institution around our fund. As a specialist fund, we get a lot of credence in today’s investment environment. We do one thing well, and that’s invest in companies that create performance for an entire sector of digital & retail companies acquiring and retaining customers. This is data, not a multiplicity of anecdotes. Our 100s of clients are telling us, our 26 portfolio companies are telling us, and the market is telling us. The results of our portfolio companies are a continued validation of our thesis. Early stage venture in the commerce enablement sector is going to continue to return dividends, grow, and create “must haves” that companies will be forced to adopt, in this quarter or the next. We believe some of those “must haves” reflect current trends in the market that every brand needs to be adopting. In 2022, we identified and invested in key up and coming commerce enablement tech players that are building within categories we’re really excited about. AI Pricing Optimization Pricing is the single most impactful lever DTC brands have to optimize margins. 90% of online shoppers compare prices across web shops for 10 mins on average before any purchase. 60% of online shoppers state “pricing” as their main decision criteria while choosing the web shop that they’ll buy from. Yet, the vast majority of ecommerce stores’ pricing is still managed manually, not in a strategic or smart way at all. That’s why we invested in Intelligems , a profit optimization engine for e-commerce brands. Merchants can run real-time A/B tests on prices, offers, and shipping fees to maximize overall profit margins. Data is collected from Shopify and Google Analytics integrations then analyzed to determine recommended prices, dynamic subscription retention offers, personalized offers, and more. Word of Mouth Marketing People who are referred to a product by a friend are 4 times as likely to buy a product, with word of mouth influencing a 54% increase in marketing efficiency. An average American mentions brands over 60 times weekly, with 90% of these name drops being online. Existing word of mouth programs are difficult to use, have low utilization rates (due to poor usability and outdated commerce experiences), and struggle to capture the voice of the customer. Most influencer campaigns drive shoppers to a homepage or PDP that cuts the influencer out of the shopping experience. That’s why we invested in Superfiliate , which powers word of mouth programs that are simple and share-worthy across two channels: influencer and referral / loyalty. The platform empowers brands’ customers and influencers with a personalized storefront optimized for conversion with UGC, reviews and brand assets. Reverse Logistics & Returns “Retailers must rethink returns as a key part of their business strategy,” said Steve Prebble, CEO of Appriss Retail. “Retail is dealing with an influx of returned items. Now is the time to stop thinking of returns as a cost of doing business and begin to view them as a time to truly engage with your consumers.” With three quarters of consumers saying returns are an essential factor in their choice of retailer, and 82% agreeing they are a normal part of shopping today- retailers can’t ignore or avoid them. If they want to survive and thrive against the challenging economic backdrop and competitive retail landscape, returns need to be embedded in their offer. That’s why we invented in Returnmates , a white glove next-day delivery and scheduled at-home returns pickup platform. Shopper schedules pickup, leaves at doorstep, and gets notified along the way. Features: Instant refunds, no labels or boxes needed, two-way customer support and live tracking. Returnmates was founded by two friends who were frustrated with their online shopping experiences due to the hassle of online returns. One day, after a 45 minute trip to the post office, they wondered "why don’t we just pick up everyone’s returns?” The light bulb went off. They called their friends- they all had the same problem. 48 hours later, Returnmates was born. Returns consolidation through Returnmates drives 10% reduction in freight costs versus slower providers like UPS and FedEx. Inventory also gets back 2 -3 days faster by shipping same day & less procrastination. We believe we are 18 - 20 months away from every brand in the United States having a home pick up returns program. AI Data Analytics + Conversion Rate Optimization The MarTech landscape has had explosive growth, requiring analysts to make sense of all this new data, but there aren’t enough analysts. Therefore, $200B of unclaimed salary in the analytics job market exists today. Enterprises are taking most of the talent, and smaller businesses are left with data unanalyzed. That’s why we invested in Clickvoyant , an analytics platform that automates analyst insights from raw marketing data and enables all businesses to have enterprise-style analytics. Costing less than an intern, Clickvoyant does a 50 hour human labor job in 10 minutes with their AI tool. Co-founder and CEO Mia Umanos’ analytics research and optimization strategies lifted revenue $4M in 90 days, took a political candidate from 4th to 2nd place, and won a Google News Initiative Grant. She has 14 years of analytics experience and was Director of Analytics at Huge and Critical Mass. Co-founder and CPO Kate Bartkiewicz can save $200M in ineffective advertising spend on a typical day. She was the Director of Analytics at Mirum, where she tripled the size of her Intel account over 2 years. Multi-Channel Commerce Optimization As of 2022, there are 841k Shopify merchants, 7.5M merchants on Etsy, 9.7M merchants on Amazon and a whopping 19M sellers on Ebay. Within the ecommerce industry, the tools necessary for managing multiple online channels have not improved much. Many of them are fragmented where users are forced to toggle multiple tools to assist with individual channels. On average, merchants spend 20 hours per week performing operational tasks to manage each channel. That’s why we invested in Vela , a multi-channel platforming tool that allows users to manage hundreds of SKUs across a variety of channels simultaneously. Social Commerce Leading brands are building, engaging, and selling through customer communities online. But the tools to activate them don’t live up to customer or brand expectations. What is more, brands don’t have ownership in YouTube, IG, TikTok, etc, and the algorithms on these social platforms currently have declining organic reach. That’s why we invested in Kinn , a platform enabling brands to rapidly launch a uniquely capable native mobile application that fuels social commerce. Kinn’s app builder bundles community engagement, live shopping, interactive video, and push notifications with the potential to add infinite features. We can’t wait to see the innovative tech companies that pop up in 2023. A few key areas we’re looking at include first party data, advertising optimization, generative media, trust & security, loyalty & rewards, upsell & checkout conversion. What do you think is next? Connect with us. - Hawke Ventures is an early-stage venture fund that invests $50k-$2M in commerce enablement, MarTech and AdTech. Between Hawke Media's client base (600+ monthly brands), growth marketing expertise (300+ employees), and Hawke Venture’s track record in early stage investing - there is no fund in the world that can match our ability to attract and develop world class entrepreneurs in commerce enablement and marketing technology.

Hawke Ventures is an early-stage venture fund that invests in Commerce Enablement Tech, MarTech, and AdTech.

Subscribe

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Hawke Ventures